|

BigGains !!

Change settings via the Web (Yahoo! ID required)

Change settings via email: Switch delivery to Daily Digest | Switch format to Traditional

Visit Your Group | Yahoo! Groups Terms of Use | Unsubscribe

Gives Information about stock movements in Bombay stock Exchange(BseIndia) Bse ,National Stock Exchange (NseIndia Nse) and stock market tips.

Sensex

|

|

From: Sharekhan Fundamental Research [mailto:marketwatch

Sent: 27 August 2009 15:31

To: Sharekhan Fundamental Research

Subject: Stock Ideas: United Phosphorus (A global agrochemical play)

| ||

| ||

|

Attachment(s) from RoHiT

1 of 1 File(s)

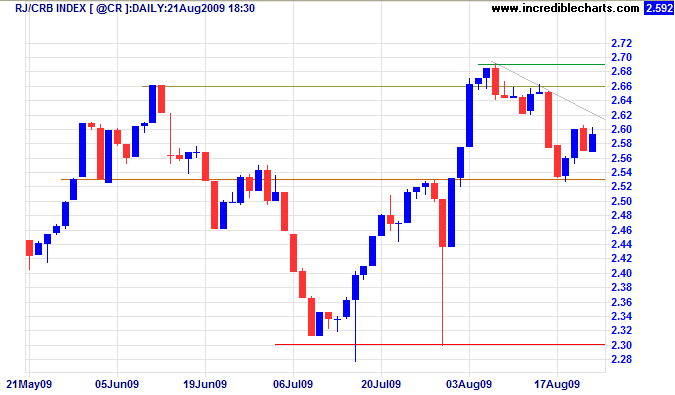

The CRB Commodities Index, shaken by the prospect of falling demand from China, is undergoing a secondary correction. Respect of the declining trendline would indicate a further down-swing, signaling weakness for resources stocks — confirmed if short-term support at 253 is broken. Breakout above the trendline, however, would suggest that the correction is over; short duration indicating a strong primary up-trend.

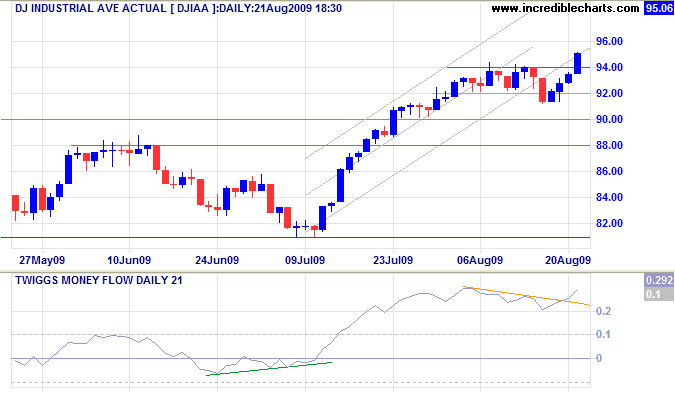

The Dow completed a bear trap after a marginal break through support (9200) reversed above resistance at 9400. Short duration of the correction indicates a strong up-trend. Expect a test of the upper trend channel, with a target of 10000*. Reversal below 9400 is unlikely, but would indicate a bullish broadening (or megaphone) wedge formation. The primary advance is confirmed by the S&P500 and Dow Transport Index.

* Target calculation: 9000 + ( 9000 - 8000 ) = 10000

We are not to expect to be translated from despotism to liberty in a featherbed.

SHREE SIDDHIVINAYAK

Wish u a very

AUSPICIOUS

GANESH CHATURTHI

May Lord Ganesh Bring Prosperity &

Glory in Your Life.

IN nature, every action has consequences, a phenomenon called the

butterfly effect. These consequences, moreover, are not necessarily

proportional. For example, doubling the carbon dioxide we belch into

the atmosphere may far more than double the subsequent problems for

society. Realizing this, the world properly worries about greenhouse

emissions.

The butterfly effect reaches into the financial world as well. Here,

the United States is spewing a potentially damaging substance into our

economy — greenback emissions.

To be sure, we’ve been doing this for a reason I resoundingly applaud.

Last fall, our financial system stood on the brink of a collapse that

threatened a depression. The crisis required our government to display

wisdom, courage and decisiveness. Fortunately, the Federal Reserve and

key economic officials in both the Bush and Obama administrations

responded more than ably to the need.

They made mistakes, of course. How could it have been otherwise when

supposedly indestructible pillars of our economic structure were

tumbling all around them? A meltdown, though, was avoided, with a

gusher of federal money playing an essential role in the rescue.

The United States economy is now out of the emergency room and appears

to be on a slow path to recovery. But enormous dosages of monetary

medicine continue to be administered and, before long, we will need to

deal with their side effects. For now, most of those effects are

invisible and could indeed remain latent for a long time. Still, their

threat may be as ominous as that posed by the financial crisis itself.

To understand this threat, we need to look at where we stand

historically. If we leave aside the war-impacted years of 1942 to

1946, the largest annual deficit the United States has incurred since

1920 was 6 percent of gross domestic product. This fiscal year,

though, the deficit will rise to about 13 percent of G.D.P., more than

twice the non-wartime record. In dollars, that equates to a staggering

$1.8 trillion. Fiscally, we are in uncharted territory.

Because of this gigantic deficit, our country’s “net debt” (that is,

the amount held publicly) is mushrooming. During this fiscal year, it

will increase more than one percentage point per month, climbing to

about 56 percent of G.D.P. from 41 percent. Admittedly, other

countries, like Japan and Italy, have far higher ratios and no one can

know the precise level of net debt to G.D.P. at which the United

States will lose its reputation for financial integrity. But a few

more years like this one and we will find out.

An increase in federal debt can be financed in three ways: borrowing

from foreigners, borrowing from our own citizens or, through a

roundabout process, printing money. Let’s look at the prospects for

each individually — and in combination.

The current account deficit — dollars that we force-feed to the rest

of the world and that must then be invested — will be $400 billion or

so this year. Assume, in a relatively benign scenario, that all of

this is directed by the recipients — China leads the list — to

purchases of United States debt. Never mind that this all-Treasuries

allocation is no sure thing: some countries may decide that purchasing

American stocks, real estate or entire companies makes more sense than

soaking up dollar-denominated bonds. Rumblings to that effect have

recently increased.

Then take the second element of the scenario — borrowing from our own

citizens. Assume that Americans save $500 billion, far above what

they’ve saved recently but perhaps consistent with the changing

national mood. Finally, assume that these citizens opt to put all

their savings into United States Treasuries (partly through

intermediaries like banks).

Even with these heroic assumptions, the Treasury will be obliged to

find another $900 billion to finance the remainder of the $1.8

trillion of debt it is issuing. Washington’s printing presses will

need to work overtime.

Slowing them down will require extraordinary political will. With

government expenditures now running 185 percent of receipts, truly

major changes in both taxes and outlays will be required. A revived

economy can’t come close to bridging that sort of gap.

Legislators will correctly perceive that either raising taxes or

cutting expenditures will threaten their re-election. To avoid this

fate, they can opt for high rates of inflation, which never require a

recorded vote and cannot be attributed to a specific action that any

elected official takes. In fact, John Maynard Keynes long ago laid out

a road map for political survival amid an economic disaster of just

this sort: “By a continuing process of inflation, governments can

confiscate, secretly and unobserved, an important part of the wealth

of their citizens.... The process engages all the hidden forces of

economic law on the side of destruction, and does it in a manner which

not one man in a million is able to diagnose.”

I want to emphasize that there is nothing evil or destructive in an

increase in debt that is proportional to an increase in income or

assets. As the resources of individuals, corporations and countries

grow, each can handle more debt. The United States remains by far the

most prosperous country on earth, and its debt-carrying capacity will

grow in the future just as it has in the past.

But it was a wise man who said, “All I want to know is where I’m going

to die so I’ll never go there.” We don’t want our country to evolve

into the banana-republic economy described by Keynes.

Our immediate problem is to get our country back on its feet and

flourishing — “whatever it takes” still makes sense. Once recovery is

gained, however, Congress must end the rise in the debt-to-G.D.

ratio and keep our growth in obligations in line with our growth in

resources.

Unchecked carbon emissions will likely cause icebergs to melt.

Unchecked greenback emissions will certainly cause the purchasing

power of currency to melt. The dollar’s destiny lies with Congress.

Warren E. Buffett is the chief executive of Berkshire Hathaway, a

diversified holding company.

From: Sharekhan Fundamental Research [mailto:marketwatch

Sent: 21 August 2009 14:40

To: Sharekhan Fundamental Research

Subject: Stock Ideas: Phillips Carbon Black (Fillip from improving demand environment)

| ||

| ||

|

Attachment(s) from RoHiT

1 of 1 File(s)