Attachment(s) from noufal tp

1 of 1 File(s)

Happy Trading,

United we grow!!!

Gives Information about stock movements in Bombay stock Exchange(BseIndia) Bse ,National Stock Exchange (NseIndia Nse) and stock market tips.

Sensex

|

Attachment(s) from noufal tp

1 of 1 File(s)

Attachment(s) from noufal tp

1 of 1 File(s)

Attachment(s) from noufal tp

2 of 2 File(s)

Attachment(s) from noufal tp

1 of 1 File(s)

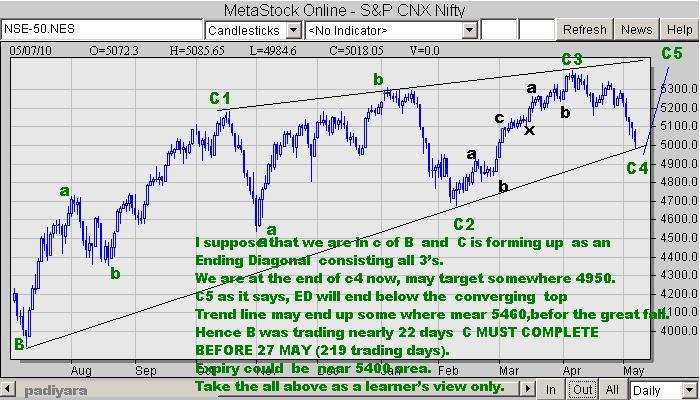

I suppose that we are in C of larger B, and C is forming up as an Ending Diagonal consisting all 3's. We are at the end of C4 now, may target somewhere 4950. C5 as it says, ED will end below the converging top Trend line may end up some where near 5460,befor the great fall. Hence B was trading nearly 22 days C MUST COMPLETE BEFORE 27 MAY (219 trading days). Expiry could be near 5400 area. Take the all above as a learner's perspective only. C2a was a sharp pattern. C3 doesn't look like a corrective But it says we must expect deviation from the basic text book models.  |

HDIL is on sharp down move. Be bearish below 281

FSL – be bearish below 30.35

Abe

From:

Sent: Wednesday, May 05, 2010 6:32 PM

To:

Subject: [sharetrading] advice from Abe sir

|

We should brace-up for a Black Monday The Black Friday is gone, but what follows will be even worse. The market you left a week ago, where deluded optimism veiled an unpalatable, yet immovable, economic reality, is beginning to melt like wax in the sun. Worse, the largest markets in Europe-France, Germany and UK fell close to 6 per cent in one wild session on Friday. Let's start with the opening act: Greece. Athenians went into Molotov-mode on Monday after details of the austerity measures required to secure a €110 billion bailout from the IMF and euro-neighbors came to light. Around 100,000 disgruntled workers thronged the streets of the nation's capital, shouting "let the plutocracy pay" and hurling projectiles at police forces. No doubt you've seen the carnage on television, so we won't rehash the theatrics here. Instead, we defer to a couple of gentlemen who have been warning of exactly this scenario for some time now. Rob Parenteau, the mind behind The Richebächer Letter, was on hand with some characteristically insightful commentary for BNN News on Thursday. The "slam dunk" bet, according to Rob, is to go short the euro. He reckons, by the time all is said and done, the beleaguered currency will fall to parity with the greenback, a 20-30% decline from here. He also sees shorting Eurozone banks as a viable way to play the "contagion vector." As you might expect, the cost of hedging against European bank defaults spiked amid all the market turmoil. The Markit iTraxx Financial Index, which measures credit-default swaps on 25 banks and insurers, soared as much as 40 basis points, according to data from JPMorgan Chase & Co. The index closed at 212 basis points on Friday as swaps on Greece, Portugal, Spain and Italy neared or eclipsed all-time highs. When the Europeans first interlinked arms, binding themselves to a common currency, they also bound themselves to a common fate. The weakest members, forever prone to overspend and underperform, were always going to rely on the stronger nations to support their high-life indulgences. This is hardly surprising. To err is human, after all. And, erring as we do, humans tend to organize larger and larger institutions to err on our behalf. Alas, this only leads to larger and larger problems, the likes of which we are only just beginning to see. "The plans of the ruling classes are not merely unjust," observed Bill, further unpacking the numbers in Friday's Reckoning. "They are unworkable. Over the next three years, Greece will add $50 billion in deficits, stabilizing the debt at 150% of GDP. It will also need to come up with $70 billion to pay off debt that matures over the next two years. That is more than the amount offered in the bailout. Which means, Greece will have to borrow more money as early as next year, probably triggering another crisis. Plus, there are the other weak sisters and spendthrift brothers in the European family. Bailing them all out could cost as much as 1 trillion euros." Alarmingly, however, Europe may not even be the most worrying harbinger for investors. While Athens was aflame, the Chinese quietly announced a slowdown in their manufacturing activity. This comes in quick-step after a series of measures by the "people's" government to rein in speculative pressures in the runaway housing market and the potential for hazardous levels of inflation. The PBOC banned loans for third homes and raised mortgage rates and down-payment requirements for second-home purchases last weekend. According to some reports, prices rose 11.7% across 70 cities in March from a year earlier, the most since data began in 2005. Andy Xie, formerly chief Asia economist at Morgan Stanley, sees China's real estate market as 100% overvalued and likens the situation there to that of the Japanese property bubble of the 1980s-90s. His concerns echo those of a Mr. Jim Chanos, who says the Middle Kingdom's economy is "on a treadmill to hell." The fire in the inferno, according to Mr. Xie, is long term, artificially depressed interest rates and an oversupply of money. [Readers may recognize a recurring theme here...] According to Xie's figures, the broad, M2 money supply in China rose from 11.76 trillion yuan in 1999 to an incredible 60.62 trillion in December of 2009. The 415% rise correlates roughly with a 453% rise in Beijing property prices observed over the same period. To put things in perspective for a moment, China's economy, with an annual GDP of some $4.35 trillion, is roughly twelve times larger than Greece's (≈ $360 billion). While it is true that the implications of a Greek default extend well beyond her own borders, is the same not also true for even a minor hiccup in China? What might a meaningful correction for the world's biggest exporter look like, we wonder? And, on the flipside, what might it spell for countries that rely heavily on supplying her voracious appetite with the raw materials for growth, like...say.. All that being said, it's incredibly difficult to get a read on exactly what's going on behind the Great Wall, which is why a group of your editors are headed to Beijing very shortly to take a look of their own. Watch this space for details... One thing is for certain, though; the actions of the past week weighed heavily on global markets. In the largest weekly sell-off since 2008, European stocks fell to fresh 7-month lows. The MSCI Asia Pacific Index posted its steepest weekly decline since February of last year, ending down 5.9% by Friday's close. And in the US, the Dow was off nearly 6% over five tumultuous sessions. The broader S&P 500 fell even further, while the NASDAQ got whacked for almost 8%. So dramatic were the drops that it is almost acceptable to question the "recovery" in polite society again. Year-to-date stock market returns may have slipped into negative territory this week, but we wouldn't worry too much, fellow reckoner. All is not lost. Not by a long shot. In other words, there ought to be plenty of opportunities for markets to sink further in the months ahead. Our suggestion? Go long gold, go long volatility.. Safe Harbor Statement: Some forward looking statements on projections, estimates, expectations & outlook are included to enable a better comprehension of the Company prospects. Actual results may, however, differ materially from those stated on account of factors such as changes in government regulations, tax regimes, economic developments within India and the countries within which the Company conducts its business, exchange rate and interest rate movements, impact of competing products and their pricing, product demand and supply constraints. Nothing in this article is, or should be construed as, investment advice. |

Attachment(s) from SHARE GURU

2 of 2 File(s)

| Reminder from: | bazaartrend Yahoo! Group | |

| Title: | Intraday Demo Bazaartrend.com on Monday | |

| Date: | Sunday May 9, 2010 | |

| Time: | All Day | |

| Repeats: | This event repeats every Saturday and Sunday. | |

| Location: | http://www.bazaartrend.com/nsecharts/intraday.php?user=demoyahoo&pass=12345678 | |

| Notes: | Hi, We are happy to get in to your NOTICE that Monday we are providing the free trail demo of our pack BASIC+Comm 1000 you can see all the market activity with live javacharts and Intraday stock recommendations and many more........ just by clicking the link below . http://www.bazaartrend.com/nsecharts/intraday.php?user=demoyahoo&pass=12345678 For any further details you can contact 09848811999 Best Regards Team Bazaartrend.com | |

| Get reminders on your mobile, Yahoo! Messenger, and email. Edit reminder options | ||

Yes SM, I do agree with you there are many defensive growthstocks are availabele tha why one should opt for range bound less of public interest stock one should trade. Even since last four years the fundamentals of the co. are not much attractive. The messageis well appreciated. But Mr. Damodar is well biased about the stock of Himalaya international. In my opinion now is the time to short and gain the money. --- On Sat, 8/5/10, sharetrading.

|