Dow & Footsie Rally Lightens Mood

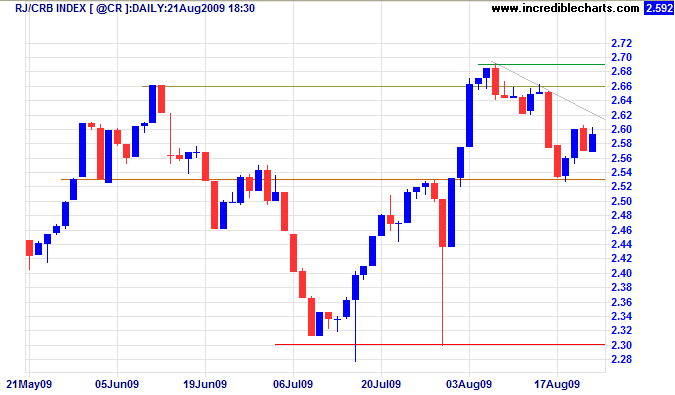

Commodities

The CRB Commodities Index, shaken by the prospect of falling demand from China, is undergoing a secondary correction. Respect of the declining trendline would indicate a further down-swing, signaling weakness for resources stocks — confirmed if short-term support at 253 is broken. Breakout above the trendline, however, would suggest that the correction is over; short duration indicating a strong primary up-trend.

USA

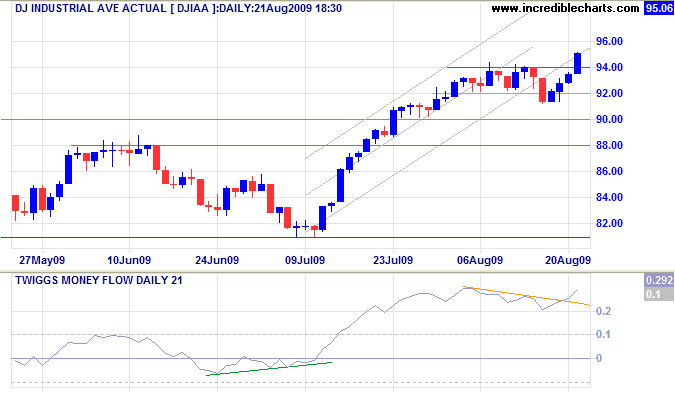

Dow Jones Industrial Average

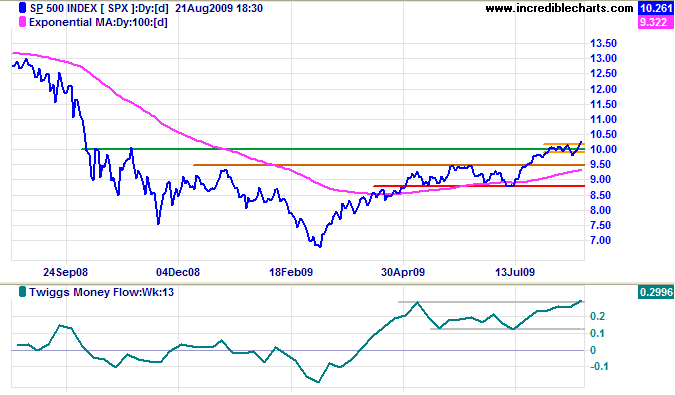

The Dow completed a bear trap after a marginal break through support (9200) reversed above resistance at 9400. Short duration of the correction indicates a strong up-trend. Expect a test of the upper trend channel, with a target of 10000*. Reversal below 9400 is unlikely, but would indicate a bullish broadening (or megaphone) wedge formation. The primary advance is confirmed by the S&P500 and Dow Transport Index.

* Target calculation: 9000 + ( 9000 - 8000 ) = 10000

We are not to expect to be translated from despotism to liberty in a featherbed.

BigGains !!

Change settings via the Web (Yahoo! ID required)

Change settings via email: Switch delivery to Daily Digest | Switch format to Traditional

Visit Your Group | Yahoo! Groups Terms of Use | Unsubscribe

1 comment:

Plz updoad money times and smart investment every week. It will boom your blog.Plz upload this week also.

Thanks

Post a Comment